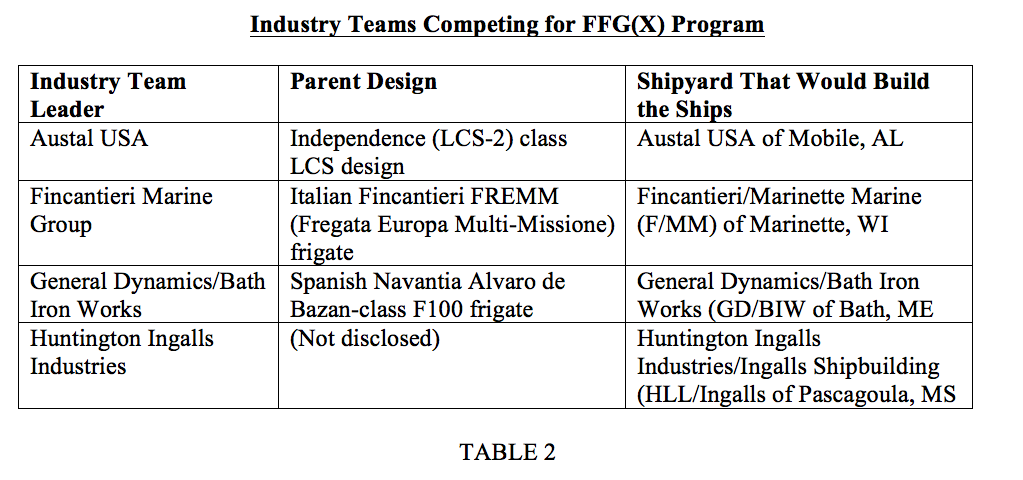

In contrast to Canada’s approach to procuring the CSC, with respect to the FFG(X) the US allowed industry to determine how to best structure its partnering arrangements in order to bid. The US insisted upon off-the-shelf ship designs and systems. The net results are worth highlighting:

1. The US Navy issued its Request for Information (RFI) in July 2017 and is expected to receive its first ship no later than Sept 2021, a lapsed time of 50 months. In contrast, Canada issued its SOIQ in September 2010. As outlined above, Canada will likely not even see construction begin (not ship delivery) before June 2023, a total of 152 months—over three times as long as the US Navy!

2. By specifying the systems and weapons it required, the US Navy guaranteed they would obtain highly integrated, already-developed and shipborne-ready systems and weapons. Reducing these risks allowed for the shortened process time and lowered the costs. In Canada no such assurances exist.

3. It is noteworthy that BAE did propose a variant of the Type 26 to the Navy in 2017, but it did not receive one of the five initial developmental contracts in 2018.[15] Clearly, the US Navy did not consider the Type 26 an off-the-shelf design.

4. The average cost per ship for the nine FFG(X) is $1,284 million in Canadian dollars. In contrast, the average production cost for the 15 CSC is estimated at $3,546 million Canadian dollars - 2.76 times more expensive.

5. As the US Navy retained program authority, bidders did not risk sacrificing their Intellectual Property to a potential competitor.

WEIGHT RISKS

In its June 2019 update on the CSC costs, the PBO reported that a key cause of the cost increase from its 2017 report was due to the forecast weight increase between 2017 and 2019.[16] Further, in correspondence with this author, the Office of the PBO indicated that, “The increase in tonnage, compared to the other factors, is responsible for the largest proportion of the increase in cost between the ’17 and ’19 estimates.” In its 2017 report, the tonnage of the CSC was estimated at 5400 tonnes. In 2019, the updated tonnage was 6790 tonnes, a 25.7% increase.

Australia is also pursuing the acquisition of a new fleet of frigates. In June 2018, the Australian government selected BAE Systems to build nine Hunter Class frigates based upon its Type 26 design. Its initial design, as pitched to the government, gave the frigate a weight of 8800 tonnes when fully loaded and a length of 149.9 metres. There are now reports that the ship’s weight is on track to exceed 10,000 tonnes, necessitating a bigger hull. This in turn will affect its speed, acoustic performance and ability to conduct stealthy anti-submarine warfare operations. The Australian Navy’s fleet is now undergoing design changes because the ships have become too heavy, risking a cost blowout for taxpayers and potentially compromising their performance.[17]

With the limited information available to the public, there is reason to be concerned that the weight of the CSC could escalate further. In its filing with the Canadian International Trade Tribunal (CITT), Alion, one of the CSC bidders, alleged that the Type 26 design was not large enough to accommodate the number of sailors Canada had specified and that the ship could not attain the speed required by Canada.

In the case of the berthing capacity, should it be necessary to add more capacity for sailor’s quarters, an increase to the size of the ship may be required. Similarly, if larger engines and more propulsion is required to allow the ship to reach the speed specified in the requirement, then it is likely the size of the ship will need to increase. These issues were never addressed in court proceedings and never addressed by the government, the Navy, Irving or LM. And so, we don’t know what impact either issue would have on the size of the ship. Significantly, a news report on the CITT case stated that the CITT’s dismissal of the complaint was not related to the content of Alion’s complaint, but to a section of the body’s regulations dealing with various trade agreements.[18]

Another issue which could affect ship weight is the SPY-7 radar. At this point, because it is a developmental radar which has yet to be marinized, we cannot know the weight or volume of the radar or how much of its infrastructure and sensors will occupy its superstructure above and below the deck. This could create weight, space and balance issues for the new vessel. We do know for certain that any increase in the length and tonnage of Canada’s CSC, would result in additional performance and cost concerns.

In summary, there is a risk that the CSC tonnage could rise to 8800 tonnes or more. Such an increase would create the same kind of performance and cost concerns experienced by the Australian Navy. An increase in tonnage from 6790 to 8800 represents a 29.6% increase and a corresponding cost increase of $8.6 billion.[19] Attaching a probability of 50% to this weight increase yields an expected cost increase of $4.3 billion.

TECHNICAL RISKS

In December 2019, CBC News reported on a number of concerns industry had raised regarding the systems and weapons that had been selected for the CSC.[20] While not identifying the source of the material, the article reported that industry was claiming that:

“The defence industry briefing presentation points out that the Lockheed Martin-built AN/SPY – 7 radar system – an updated, more sophisticated version of an existing U.S. military system – has not been installed and certified on any warship. A land-based version of the system is being produced and fielded for the Japanese government. The briefing calls it “an unproven radar” system that will be “costly to support” and claims it comes at a total price tag of $1 billion for all of the new ships, which the undated presentation describes as “an unnecessary expenditure.”

The industry briefing also raised concerns about DND’s choice of a main deck gun for the frigates – a 127-millimetre MK 45 described by the briefing as “30-year-old technology that will soon be obsolete and cannot fire precision-guided shells.” The other system it drew attention to was the “inadequate Sea Ceptor Close-In Air Defence system, which is meant to shoot down incoming, ship-killing missiles”.

Owing to the lack of transparency within the Canadian CSC procurement process, it cannot be confirmed whether these assessments are accurate. But they raise a number of critical questions. What is the risk that the chosen systems will not provide the capability necessary to undertake the missions required of the Navy? What is the rationale for the selection of an old gun for a modern warship? What is the cost and risk from both schedule and capability standpoints of choosing systems not yet fielded? Who is going to pay for the development costs of unproven systems?

Interestingly, the US FFG(X) is equipped with the SPY-6 radar and the SeaRAM MK15, Mod31 Close-In Air Defence (CIAD) system. This does not mean that Canada should necessarily have the same suite of systems and weapons. But since we have chosen not to, it certainly is worth finding out why not. These systems were selected by the US Navy because they are proven, in production and represent the lowest risk solution, whilst maximizing commonality across the USN fleet. Replicating these two systems could represent potential for cost savings for Canada. The development, integration, validation and certification for these systems will have been done and paid for by the US Navy. In particular, significant cost savings could materialize with respect to the radar. Through the end of FY2018 the US Navy had spent $545 million (USD) developing the SPY-6 radar and is expected to spend another $472 million (USD) through the end of FY 2025 (for a total of $1,017 million (USD)) on this program.[21] Canada would therefore not have to bear any of these development costs for the SPY-6 radar.

In contrast, the SPY-7 radar is currently a land-based system designed for early warning and ballistic missile defence. There will be costs to convert it for use on warships not dissimilar to the costs borne by the US Navy for SPY-6 development. Canada, with its apparent commitment to put the SPY-7 on its fifteen CSC, Spain with its commitment to put it on its five new F-110 frigates[22] and possibly Japan (as of this date, no final decision taken)[23] would likely bear some of these costs to address items such as antenna mast integration, below-decks configuration and environmental qualification. In addition, Canada would have to bear the costs for verification testing and missile fly-out certification, which involves lease costs for appropriate test facilities (like the US Pacific Missile Range Facility (PMRF)), expenditures of missile inventory and deployment of CSC test ship. As these costs are not clearly specified, the author has factored in a nominal incremental cost to Canada of $100 million to bring attention to these matters.

With respect to the main deck gun, Canada has specified the requirement for a 127 mm gun. It defies logic to think that the LMC/BAE team would propose a deck gun that is apparently no longer in production. However, if the allegation is true, then the reconciliation phase provides the opportunity to make the appropriate substitution. Deck guns that are used or refurbished have no place on what is described as a state of the art warship.

CONCLUSION

Warships are incredibly complex systems. They combine an extremely sophisticated weapons platform for air defence, surface and underwater warfare, with a restaurant, a hotel, an airport, a recreation and fitness centre, an armoury and a sanitation system – all of which must operate in the hostile environment of the open ocean and travel at speeds approaching 30 knots. It is little wonder that the proposals to build the CSC consumed tens of thousands of pages.

As the largest procurement in the history of the Canadian Government, it is vital that the CSC project not be allowed to flounder or run aground. New warships for the Royal Canadian Navy are urgently required to replace the 25-year-old Halifax Class frigates. However, the acquisition process initially adopted by the previous Conservative Government and continued under the current Liberal Government, will very likely produce perhaps the costliest warships (for their size) of any similar ships anywhere in the world.

This runs counter to what Kevin McCoy, President of Irving, indicated in an interview with CBC News in May of 2016. The story quoted McCoy as stating: “What we have said consistently to the Government of Canada is: Canada should pay no more for their warships than other nations with like-minded aspirations.” Paraphrasing McCoy, the story also added that “sticker shock among the public is always a concern, but promised the federal government will pay a fair price for its warships."[24] Canada desperately needs new warships – but they should not be acquired at any cost.

When it was conceived, the intent of the National Shipbuilding Procurement Strategy was indisputably laudable. There was a natural desire to create sustainable well-paying jobs and avoid the boom and bust shipbuilding scenarios that have characterized the industry in the past. The inclination of a federal government that lacked the expertise to conduct a program of this magnitude was to push responsibility and accountability to the private sector. As events are in the process of demonstrating, it was a titanic miscalculation. It was simply the wrong thing to do.

In this particular case, both major political parties – Conservatives and Liberals - have significant culpability for a defective process that has been long, convoluted and expensive. Senior bureaucrats also bear a large responsibility for conceiving of, or acquiescing to, this seriously flawed process. Correcting the flaws in this procurement should be approached not as a partisan exercise, but as a collective public policy challenge where ideas are judged on their quality rather than their party origin.

This paper has provided a snapshot in time concerning what might be expected in terms of costs for the CSC program. However, it would be incomplete if it did not offer some recommendations.

RECOMMENDATIONS

1. Government officials should immediately intervene in the current process to understand the full costs of the program including long term support costs.

2. Government officials should ensure that the suite of selected systems, subsystems and weapons are cost effective and will provide the capability to undertake the missions required of the Navy. Examples of such systems include the radar, CIAD system and main deck gun.

3. Officials must determine whether DND modified the SOR, and if so, why. In the interest of transparency, their findings should be made public.

4. The government should structure a Cabinet sub-committee to oversee the CSC program. Within the bureaucracy, one clear point of accountability should be established and that individual should provide monthly updates on progress made.

5. Close oversight should be maintained by Cabinet and Parliament. The Standing Committee on National Defence should also be provided with regular updates and should conduct regular hearings on this program.

6. The current process should be limited to the acquisition of the first three CSC. A new procurement process should be established for the remaining 12 ships. Every effort should be made to ensure that a full complement of 15 warships is constructed for the Navy.

7. In any new process:

· The government should retain procurement authority;

· The government/Navy should specify its requirements and demand systems and weapons that require minimal integration and that are developed and shipborne-ready. The ship design must be based upon an existing operational ship design.

· The government should allow for the formation of competing industry teams to meet the government’s requirements with each team identifying its accountable team leader, its members, its proposed off-the-shelf design and its proposed shipyard(s). (After all, more than one shipyard is possible). It should not preselect the shipyard or any member of any team as it did in the current process. As with the FFG(X), the government/Navy should be able to specify certain systems as Government Furnished Equipment.

8. As a first step, PSPC and DND officials should consult with industry to obtain their advice and insights on the way ahead.

9. The new process should establish a budget that is realistic and no more than a three-year schedule to enter into a construction contract.

10. The PBO should refer its study to the Auditor General of Canada who should work with the PBO on an urgent basis to undertake a more detailed review of the entire CSC program relating to process and cost.

Full Disclosure Mr. Williams has worked as a consultant for various companies involved in the Canadian Surface Combatant project. These include Alion, Leonardo DRS, Leonardo Defence Systems, and Raytheon. The views presented here are his alone and do not represent the views of the companies he has worked with. All information contained in this article is from publicly available sources.